new haven county property taxes

A serviceman having any questions in regard to motor vehicle property taxes or in need of an application to complete and file in sufficient time to meet filing dates to apply for such benefits should contact the local assessor. City of New Haven.

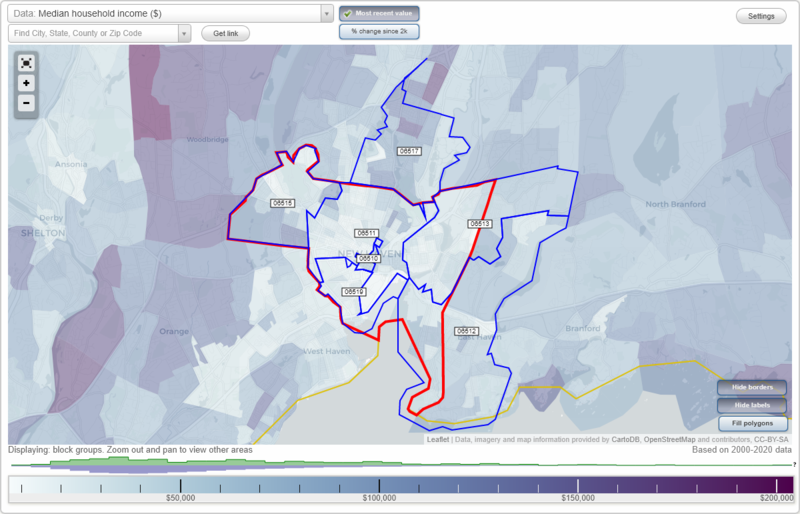

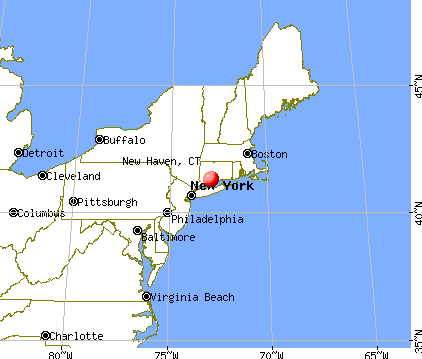

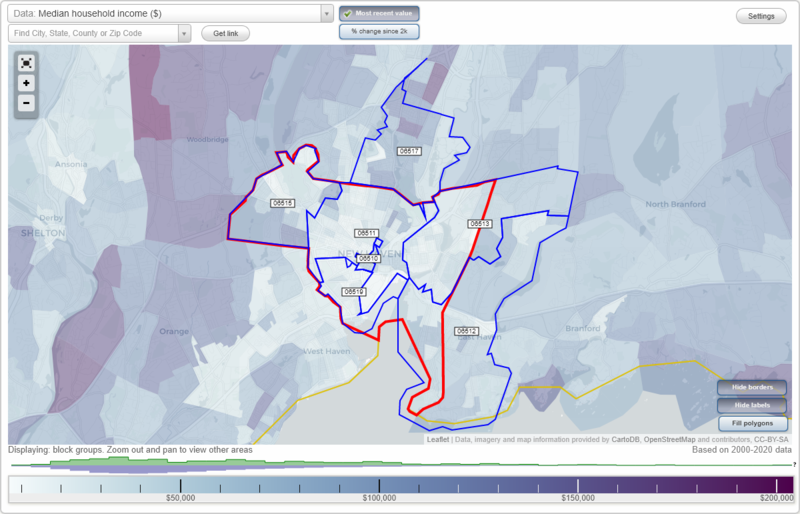

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

3 rows New Haven County Property Tax Payments Annual New Haven County Connecticut.

. Revenue Bill Search Pay - City Of New Haven. This is a positive re-affirmation that investing in real estate in these areas is an adequate opportunity for modest growth. New Haven County collects very high property taxes and is among the top 25 of counties in the United States ranked by property.

View the Full Range of County Assessor Records on Any Local Property. Taxes-Consultants Representatives 2 More Info. Delinquent Taxes are paid to the Shiawassee County Treasurer.

New Haven County Property Tax Collections Total New Haven County Connecticut. Naugatuck Connecticut 06770. Certain types of Tax Records are available to the general public while some Tax Records are only available by making a Freedom of Information Act FOIA request to access public records.

Name A - Z Ad Optima Tax Relief. Account info last updated on Jul 4 2022 0 Bills - 000 Total. The median property tax in New Haven County Connecticut is 4621 per year for a home worth the median value of 273300.

Estimated Real Estate Property Tax Calculator. New Haven CT 06510 Office Hours Monday - Friday 900am - 500pm. 11100 of Asessed Home Value.

Payments made by personal checks in office or by mail will have an automatic five 5 business day hold unless you provide proof of payment before that time. All payments made after 8 pm Monday-Thursday allow 48 hours to be. You can call their office at 989-743-2224 to inquire about making payment.

View GIS Parcel Map. Property Taxes No Mortgage 382955200. The median property tax on a 27330000 house is 286965 in the United States.

213 of Asessed Home Value. Find New Haven County residential property records including property owners sales transfer history deeds titles property taxes valuations land zoning records more. Use the Newly Enhanced Comparable Search.

Owners of real personal and motor vehicle property are taxed at a rate of 1 on every 1000 assessed. Deliquient taxesInterest owed or assessment deferral agreements which are still being re. Home Shopping Cart Checkout.

The median property tax on a 27330000 house is 461877 in New Haven County. Left to the county however are appraising real estate sending out levies taking in collections implementing compliance and addressing conflicts. YEARS WITH 800 910-9619.

The Town of New Haven. BSA Software and a fast growing list of governmental municipalities have created a partnership to help provide a fast and convenient way for their constituents to view valuable data online. All payments made online before 8 pm Monday-Thursday are uploaded posted on the next business day holidays excluded.

Enter the Address Here. View Cart Checkout. Then a hearing concerning any planned tax increase has to be convened.

Therefore a real estate property assessed at. See reviews photos directions phone numbers and more for Property Taxes locations in New Haven KY. The Town of New Haven property values on average have risen 247 in the last 10 years from a Total Equalized Value in 2008 of 127582000 to a Total Equalized Value in 2018 of 159190000.

Property Taxes in New Haven CT. Find comparable property. Home CT New Haven County Parish Government.

Counties perform real estate appraisals for New Haven and special purpose public districts. The median property tax on a 27330000 house is 445479 in Connecticut. Property Taxes Mortgage 846861200.

Its taken times the established tax levy which is the sum of all applicable governmental taxing-authorized entities levies. Please note that this calculator returns an approximate value and does NOT account for personal exceptions Elderly Disabled Veterans. DMV Property Tax Unit.

New Haven County Connecticut. Phone 203 946-4800 Address 165 Church St. Borough of Naugatuck Assessor.

203 720 7016 Phone 203 720 7207 Fax The New Haven County Tax Assessors Office is located in Naugatuck Connecticut. The DMVs Property Tax Section may be reached by by phone at 860 263-5153 or by mail at. The median property tax also known as real estate tax in New Haven County is 462100 per year based on a median home value of 27330000 and a median effective property tax rate of 169 of property value.

Per the FY 2022-2023 Mayors Proposed Budget. While observing constitutional restrictions mandated by law New Haven enacts tax rates. If you received a tax bill for a vehicle not garaged in New Haven as of October 1 2021 contact.

Ad Search Property Tax Records from Home Without Lines or Paperwork. Assessments Property Taxes. Personal property and motor vehicle are computed in the same manner.

This calculator can only provide you with a rough estimate of your tax liabilities based on the. There is a 3 fee for non-residents to access the information. New Haven County has one of the highest median property taxes in the United States and is ranked 39th of the 3143 counties in order of median.

Residents can check their property tax information for free online. Free New Haven County Property Records Search. They range from the county to New Haven school district and various special purpose entities such as sewage treatment plants amusement parks and property maintenance facilities.

Get driving directions to this office. Effective tax rate New Haven County. Corunna MI 48817.

New Haven Township Treasurer. New Haven County collects on average 169 of a propertys assessed fair market value as property tax. City Of New Haven.

These records can include New Haven County property tax assessments and assessment challenges appraisals and income taxes. If New Haven County property tax rates are too costly for your revenue resulting in delinquent property tax payments a possible solution is getting a quick property tax loan from lenders in New Haven County CT to save your property from a potential foreclosure. City Assessor Alex Pullen Email.

23200 of Asessed Home Value. Welcome to the Internet Services Site a cutting-edge internet solution for Government.

Woodbridge Conn A Rural Enclave Close To New Haven The New York Times

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Connecticut Property Tax Calculator Smartasset

Town Of Watertown Tax Bills Search Pay

The Audubon New Haven New Haven Ct Apartments For Rent

Assessor S Office New Haven Ct

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders

Yale Sends City 14 4m Check New Haven Independent

New Haven Ct Multi Family Homes For Sale Real Estate Realtor Com

Town Of Watertown Tax Bills Search Pay

House Adopts One Of The Largest Tax Cuts In Ct History

How 100m Flowed To Megalandlords New Haven Independent

Many New Haveners To See Property Tax Increases After Revaluation Yale Daily News

New Haven Connecticut Ct Zip Code Map Locations Demographics List Of Zip Codes

Faqs On State Legislation To Tax Yale S Academic Property Yalenews

Timeline For Property Taxes Carver County Mn

New Haven Financially Speaking A Slowly Sinking Ship

New Haven Connecticut Ct Profile Population Maps Real Estate Averages Homes Statistics Relocation Travel Jobs Hospitals Schools Crime Moving Houses News Sex Offenders